Calculate the Estimated Total Manufacturing Overhead Cost for Each Department

Factory Overhead Rate Estimated Expenses Estimated Machine Hours 300000500060 per Machine Hour. Direct materials direct labor manufacturing overhead total manufacturing cost.

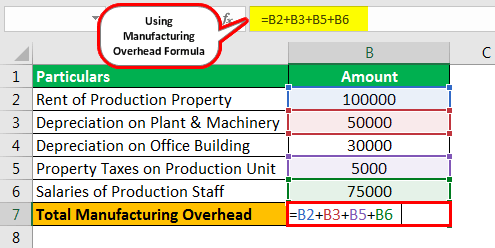

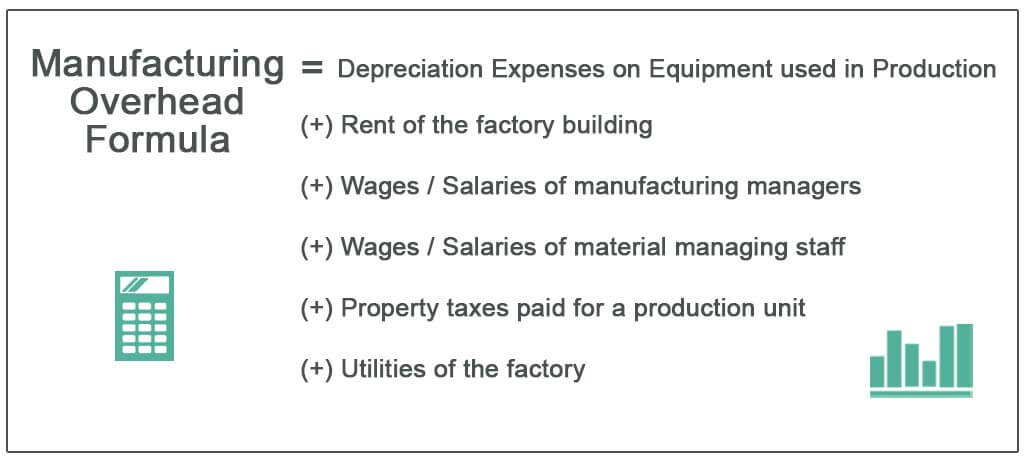

Manufacturing Overhead Formula Step By Step Calculation

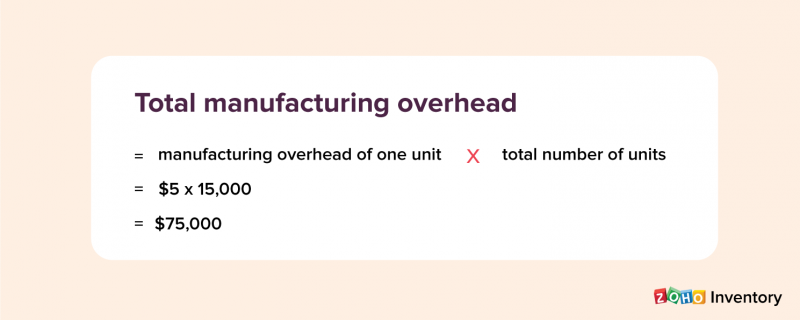

Calculate the predetermined overhead.

. If you used direct labor hours to calculate the rate use actual direct labor hours. Material costs of respective cost centers. Here is the formula to measure total manufacturing costs.

Total manufacturing overhead cost est. Calculate cost of materials. Total Manufacturing Cost formula.

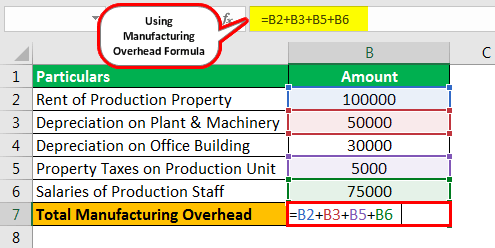

To find the manufacturing overhead per unit In order to know the manufacturing overhead cost to make one unit divide the total manufacturing overhead by. To compute the overhead rate divide your monthly overhead costs by your total monthly sales and multiply it by 100. Accounting questions and answers.

Estimated Manufacturing Overhead Cost 48 million. So the total manufacturing overhead expenses incurred by the company to produce 10000 units of cycles is 50000. Predetermined Overhead Rate Estimated Manufacturing Overhead Cost Estimated Units of the Allocation Base for the Period.

Total manufacturing cost Direct materials Direct labour Manufacturing overheads. Estimated total manufacturing overhead cost Estimated total fixed manufacturing overhead cost Estimated variable overhead cost per unit of the allocation base Estimated total amount of the allocation base 144000 120000 264000. 390000 200 per MH 60000 MHS 500000 375 per DLH 80000 DLHs 390000 120000 500000 300000 510000 800000 Step 2.

The costs of direct materials direct labour and manufacturing overheads. Therefore the Total Manufacturing Cost formula is this. For example if your company has 80000 in monthly manufacturing overhead and 500000 in monthly sales the overhead percentage would be about 16.

Add up the overhead from each department to calculate the total overhead. The finance head is referring to indirect overhead cost which shall be incurred irrespective of whether the product is manufactured or not. Manufacturing Overhead Rate Overhead Costs Sales x 100.

Therefore the calculation of manufacturing overhead is as follows 7141500 14283000 10712250 714150. Predetermined overhead rate est. Calculate the estimated total manufacturing overhead cost for each department.

In the following example calculating the overhead rate for the material overheads is done by dividing the total overhead cost of 30000 by the calculation base of 100000 giving a rate of 03 30. To Compute the Manufacturing Overhead Cost for Each Employee Owners need to consider. Total amount of the allocation base.

Predetermined Overhead Rate is calculated using the formula given below. To calculate total manufacturing cost you add together three different cost categories. Assembly Department Overhead Cost Y.

Estimated Manufacturing Overhead Cost 30 million 10 million 5 million 3 million. Expressed as a formula thats. 390000 200 per MH x 60000 MHS 500000 375 per DLH x 80000 DLHs 390000 120000 500000 300000 510000 800000 Step 2.

300000200000150 per DLH OR. Total Manufacturing Cost Direct Materials Direct Labor Manufacturing Overhead. Using labor-burden analysis you can determine exactly what each employee costs and then include both fully-burdened direct labor and fully-burdened indirect labor production or manufacturing overhead costs into both your estimated and actual costs.

Is computed by dividing the total estimated manufacturing overhead cost for the period by the estimated total amount of the allocation base as follows. Milling Department Overhead Cost Y. Use these four steps to compute total manufacturing costs for a product or business.

To calculate the total manufacturing overhead cost we need to sum up all the indirect costs involved. To find the Total Manufacturing Cost just add together the aforementioned three key costs from the specified financial period. How to calculate total manufacturing cost.

Calculate the estimated total manufacturing overhead cost for each department. Applied overhead for each department Departmental overhead rate x Actual activity using the same driver used to calculate the rate If you used estimated machine hours to calculate the rate use actual machine hours. Thats the simple version.

Milling Department Overhead Cost Y. Assembly Department Overhead Cost Y. To calculate overhead costs simply divide the total by the calculation base with the latter referring to the direct costs eg.

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Predetermined Overhead Rate Formula Calculator With Excel Template

No comments for "Calculate the Estimated Total Manufacturing Overhead Cost for Each Department"

Post a Comment